More Unscrupulous Dealings from The World of External Wall Insulation

We have previously warned about the double standards being operated by some external wall insulation installers with regard to the guarantees being offered on these systems. DECC insisted that these systems came with a 25 year guarantee if they were to be rolled out to the mass market; enter SWIGA, the company formed to provide those guarantees. However, it seems that a large proportion of the industry is only providing those guarantees for grant funded work, such as ECO funding. If you are a cash buyer for one of these systems then there is a strong chance that you will be offered a substantially reduced guarantee. I have a client who was only offered a 12 month guarantee, though their installer later offered to pass on the system manufacturers 5 year materials guarantee, which is fairly pointless. When made aware of the 25 year SWIGA guarantee my client questioned this but found that their installer was not a member of SWIGA and therefore could not offer the 25 year guarantee. As grant funded work dries up we are seeing a number of installers sever ties with SWIGA or generally failing to maintain any links with a body that can provide the appropriate level of insurance protection. After all, if the Government isn’t forcing you to offer a 25 year guarantee then why pay membership to an organisation that oversee’s an insurance scheme that you are not offering to clients. Irrespective of whether work is privately or grant defended this application of double standards is an industry scandal. In this particular case the installer was recommended to my client by the system manufacturer, despite that installer having no way to provide the appropriate guarantee. Should we expect material suppliers to carry out some level of due diligence to ensure that their recommended installers can offer an appropriate guarantee? I think so, and if you can’t do this then don’t make recommendations!

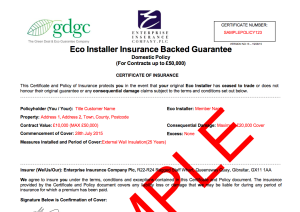

If you have followed this blog then you will be aware that the system failed within weeks of being applied leading to months of conflict and disagreement. One culmination of the disagreement over the guarantee being offered, or rather, not being offered, was the installers suggestion that they would now provide the following system guarantee…

To my mind this raised a very obvious question, which is, can you actually get insurance cover for an EWI system that has already failed? Possibly… but as with all things risk related, the greater the risk, the more you pay to offset that risk. In this case we are fairly confident that the insurance company would refuse to insure a previously failed and repaired system, or they would increase the premium to such an extent that the installer would not want to pay the price. We are fairly confident that the system failure was not disclosed to the insurer because the insurer would have wanted to know the full facts relating to the cause of failure and repair in order to help their loss adjusters reach a decision. So in fact a guarantee is being offered when the insurer is not yet in receipt of all the facts relating to the case. We’d go so far as to say that having spoken to this insurer, the policy may not actually be available under these circumstances. It goes without saying that it would be construed as fraud to obtain an insurance policy without disclosing all material and relevant facts and I’d consider substantial failure of the system within weeks of application as fairly relevant, wouldn’t you? You can pick holes in a lot of these policies until the cows come home and the fact remains that the vast majority of EWI failures are caused by poor workmanship, inadequate design or poor site storage of materials. Given that poor workmanship is the primary common cause of failure then you’re left in dispute with your contractor because a lot of these policies only pay out in those circumstances if your contractor is no longer around to deal with it. There are a lot of aftermarket guarantees and you should study them carefully if you’re placed in an unfortunate position of having to buy one. To avoid this proverbial stable door simply ensure that your installer is registered with SWIGA and can provide the full 25 year protection; If not then find an installer who can! Oh, and please budget to have your installation independently quality managed, we guarantee that you’ll be glad you did.

Leave a Reply